📌 My Work

These are a few projects I’ve been lucky to work on — across public finance, climate tech, and capital design. Each one taught me something about how hard (and necessary) it is to build systems that actually work.

If you're curious about my broader experience, feel free to reach out for my CV.

Clean Crop — Co-Founder

Founded a digital platform enabling smallholder rice farmers in India to adopt Alternate Wetting and Drying (AWD) — a cultivation method that reduces methane emissions by 48% and water use by 30%. Designed the end-to-end delivery stack: mobile-based training, traceability tools, premium market linkages, and a blended finance mechanism to fund adoption. More here

Video 1, Video 2, Cleancrop @ GPPN

📚 Research & Publications

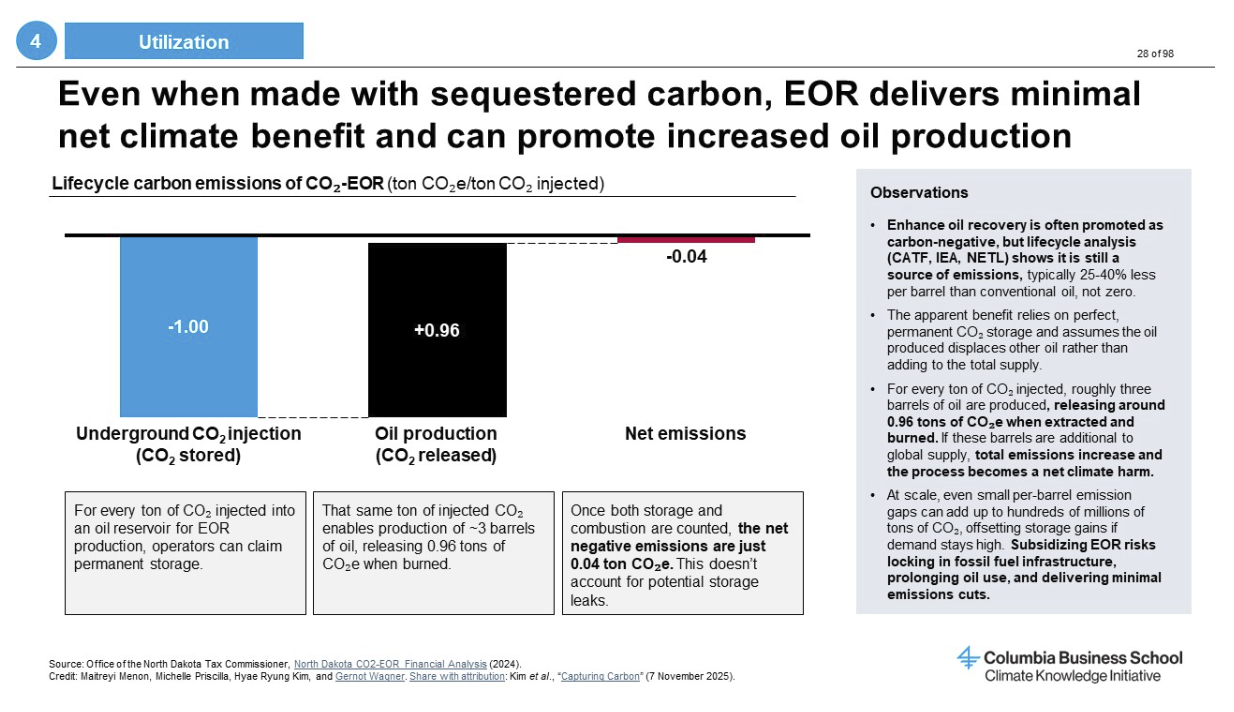

CCUS's Role in the Path to Net-Zero— Climate Knowledge Initiative, Columbia Business School - Report[NEW]

Carbon Capture, Utilization, and Storage (CCUS) captures CO2 at the source from industrial facilities (point-source capture) or directly from the atmosphere (direct air capture). CCUS can abate up to 6 gigatons of CO2 annually and play a strategic role in decarbonizing hard-to-abate sectors like cement, steel, and chemicals.Read my work on CCUS dive to learn how this technology works and its role in achieving net-zero emissions by 2050 - Read here

Carbon Capture's 'Yes,and' Role in Climate Action - Article [NEW]

Read my article on why the future of industrial decarbonization hinges on getting carbon capture economics right on Columbia Business School's blog. Read Here

UN DESA + SIPA — Infrastructure Investment Strategy for The Gambia

Co-led a national infrastructure strategy project with the UN Department of Economic and Social Affairs. Conducted institutional and financial diagnostics on asset lifecycle management in The Gambia, and proposed governance, fiscal, and data reforms to improve infrastructure resilience and investment readiness - Read here

Blended Finance in India — Asha Impact, SocGen, Impact Investors Council

Co-authored the first open-source dataset and analysis of ~180 blended finance transactions in India. Mapped structural inefficiencies, transaction archetypes, and critical constraints to scaling catalytic capital across sectors including energy, ag, and financial inclusion. Read here

Practitioner’s Guide to Blended Finance — Villgro + Desai & Associates

Co-developed a field manual for designing blended capital structures for early-stage impact ventures. The report synthesizes insights from 25+ stakeholders and recommends design mechanisms such as concessional senior tranches, revenue-based recovery, and outcome-contingent grant layers. Read here

Reforming Blended Finance for Scale — Columbia Center on Sustainable Investment

Supported the authorship of a systems-level critique of why blended finance has failed to scale in EMDEs. Research included 65 expert interviews and proposed reforms to MDB structures, regulatory barriers, and liquidity constraints in emerging market infrastructure financing. - Read here

ASEAN Green Future — SDSN + Columbia Center on Sustainable Investment

Contributed to power sector integration strategy under ASEAN’s regional decarbonization initiative. Work included grid modeling, investment risk design, and stakeholder engagement with ADB, IFC, and national energy ministries on multilateral energy infrastructure and financing frameworks - Read here

🧠 Fellowships & Leadership

David Leuschen Fellow — Center on Global Energy Policy (CGEP)

Awarded Columbia’s most selective climate energy fellowship for policy and finance leadership. My research focuses on sovereign-scale energy transition strategies, public-private investment design, and the role of geopolitics in shaping climate capital flows. More here

President — Columbia Impact Investing Network (CI3)

Led Columbia’s flagship student-run impact investing initiative, managing semester-long consulting projects with real-world investors and entrepreneurs. Oversaw sourcing, team management, and programming at the intersection of climate capital and student leadership.